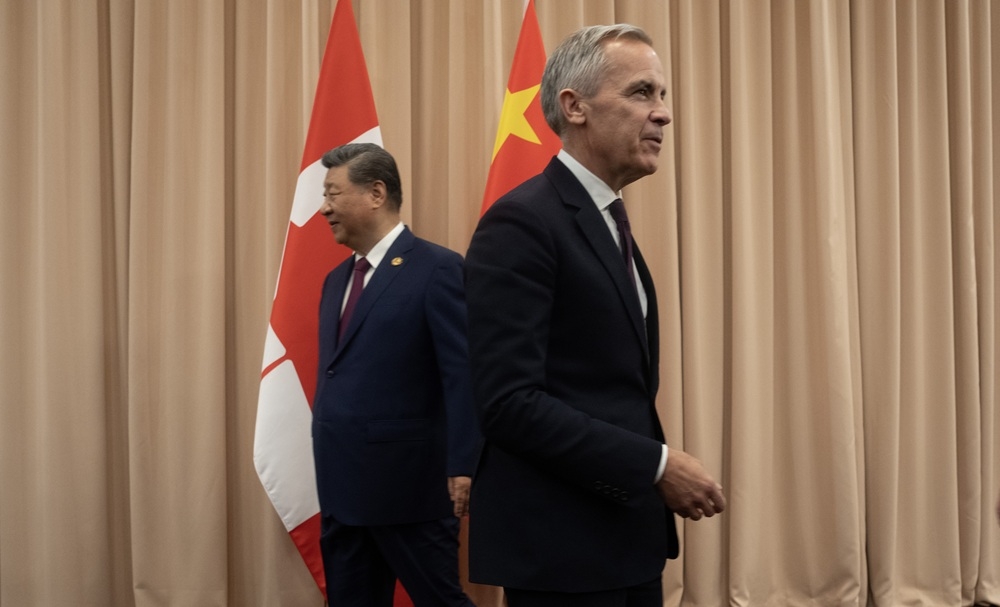

Ottawa faces a stark financial reality as it prepares to unveil its new budget. A recent report reveals a significant deficit, painting a challenging picture for the nation’s economic outlook.

Between April and August, the federal government recorded a deficit of $11.1 billion – a substantial increase of $1.3 billion compared to the same period last year. This growing gap underscores the pressures facing the government as it navigates complex economic headwinds.

Rising expenses are a key driver of the deficit. Increased program spending, particularly on Employment Insurance benefits, reflects the ongoing struggle with a persistently high unemployment rate. The need to support those out of work is significantly impacting the national budget.

Canada’s unemployment rate remains stubbornly high, holding steady at 7.1% in September. This marks a level not seen since August 2021, signaling a slower-than-expected recovery in the job market.

The summer months offered a brief respite, with unemployment dipping to 6.9% in June and July, but this improvement proved fleeting. The figures remain considerably higher than the 6.6% recorded earlier in the year, during January and February.

Beyond unemployment benefits, increased spending on old-age benefits is also contributing to the rise in program expenses. The government is committed to supporting its senior citizens, but this commitment comes at a considerable financial cost.

Total program spending between April and August reached $179.8 billion. This represents a significant investment in vital social programs, but also highlights the scale of the financial challenge.

Despite the deficit, government revenues have seen an increase, totaling $201.2 billion. This rise is fueled by higher income tax revenue and a boost in import duties, partially offsetting declines in sales tax revenue.

Last year, during the same period, revenues stood at $196.3 billion. While the increase is encouraging, it’s not enough to close the widening gap between spending and income, setting the stage for difficult decisions in the upcoming budget.