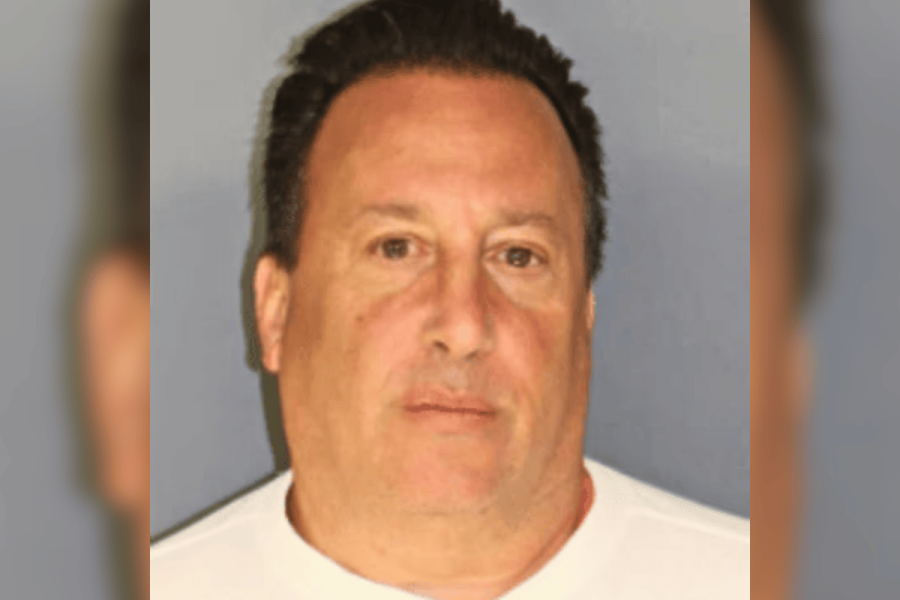

A respected Essex County accountant is now facing serious criminal charges, accused of a stunning betrayal of trust. Michael Delia, 61, allegedly stole over $1.6 million from a longtime client and the client’s businesses, diverting the funds for a life of personal indulgence.

The alleged scheme spanned nearly seven years, from 2016 to August 2023, during which Delia exploited his position as accountant and bookkeeper. He systematically funneled company money into accounts he personally controlled, masking the theft through a complex web of transactions.

Investigators uncovered a disturbing pattern of spending, revealing that the stolen funds were used to settle credit card debts, fuel a sports betting habit, and even cover mortgage payments. The scale of the alleged fraud is significant, painting a picture of deliberate and calculated deception.

Beyond the theft from the client, authorities allege Delia also defrauded the state of New Jersey. Over three years, from January 2020 to July 2023, he diverted over $910,000 in collected sales taxes into his own accounts, funds intended for vital public services.

The accusations don’t stop there. Prosecutors claim Delia wrote himself unauthorized checks totaling over $733,000, effectively treating the companies’ accounts as his personal piggy bank. This brazen act further underscores the alleged breach of trust.

Delia allegedly routed state funds through a business he registered in 2013, STP Processing, further complicating the financial trail and attempting to conceal his actions. In 2023 alone, over $126,000 owed to New Jersey was allegedly diverted to this entity.

The charges against Delia include two counts of second-degree theft, one count of second-degree money laundering, and one count of second-degree failure to remit collected taxes. Each charge carries a potential sentence of five to ten years in state prison and fines up to $150,000.

Authorities emphasize that these are allegations, and Delia is presumed innocent until proven guilty in a court of law. However, the case serves as a stark reminder of the importance of vigilance and accountability in financial dealings.