For the first time, the brothers who built a betting empire have topped the list of the UK’s highest taxpayers. Fred and Peter Done, the founders of Betfred, paid a staggering £400.1 million in taxes over the past year, eclipsing even prominent musicians and established aristocratic families.

Their journey began with a single, fateful bet – a winning wager on England’s 1966 World Cup victory. That initial windfall fueled their ambition, leading to the opening of the first Betfred shop and, ultimately, a network of over 1,300 locations across the UK.

The Sunday Times Tax List revealed a collective £5.758 billion paid by the top 100 taxpayers, a significant 15.5% increase from the previous year. The Done brothers’ contribution alone exceeded the next highest taxpayer by a remarkable £68.7 million.

However, their success hasn’t come without warnings. Fred Done cautioned last year that increased taxes could force shop closures, predicting it would be the most significant challenge the industry had ever faced – a prediction that unfortunately materialized with a subsequent rise in UK betting taxes.

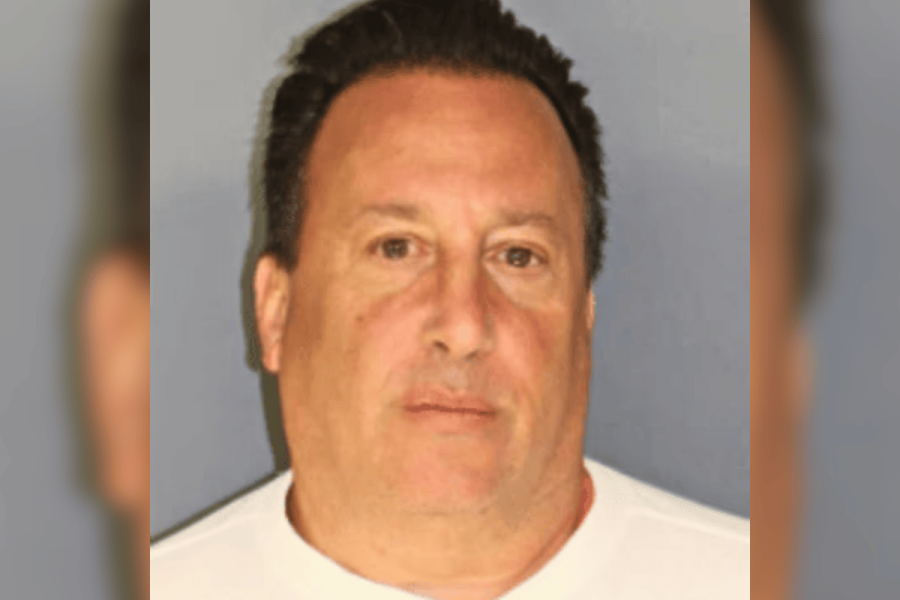

The second-highest taxpayer was revealed to be Alex Gerco, a London-based trader originally from Moscow, who contributed £331.4 million to the UK’s tax revenue. His inclusion highlights the diverse sources of wealth within the country’s highest earners.

Beyond the brothers’ personal tax bill, Betfred itself faced scrutiny and a substantial fine. Regulators found the company lacking in its ability to prevent money laundering and identify potential gambling harm linked to its gaming machines.

This resulted in a penalty of £825,000, a stark reminder that financial success carries with it a responsibility to operate with the highest standards of compliance and customer protection.